Avoiding Middle-Class Traps: Strategies for Financial Freedom

Ever wondered why it's so challenging to leap from the middle class to the wealthy elite? The transition from being comfortable to being truly wealthy often requires dodging a series of financial pitfalls that many middle-class individuals fall into. In this post, we'll uncover these common traps and share strategies to help you break free from them.

1. The Credit Card Conundrum

Credit cards, while convenient, can be a double-edged sword. They offer immediate purchasing power but often at a high cost.

Why It’s a Trap:

- Ease of Access: It's tempting to use credit cards for purchases when cash is short. However, this leads to spending money you don't have.

- High Interest Rates: If you can't pay off the balance each month, interest charges accumulate rapidly, increasing your debt significantly.

- Debt Spiral: Many people find themselves paying off interest more than the actual principal amount, trapping them in a cycle of debt.

Avoiding the Trap:

- Budget Wisely: Only spend what you can pay off at the end of the month.

- Monitor Your Credit Score: Regularly check your credit score and aim to maintain a good rating by paying off debts on time.

- Emergency Fund: Build an emergency fund to cover unexpected expenses instead of relying on credit.

2. The Mortgage Mirage

Owning a home is often seen as a hallmark of success, but it can also be a financial burden.

Why It’s a Trap:

- Long-Term Debt: Mortgages can tie you down with decades of payments, reducing your financial flexibility.

- Hidden Costs: Maintenance, insurance, and property taxes can add up, making homeownership more expensive than anticipated.

- Opportunity Cost: The money tied up in your home could potentially earn more if invested elsewhere.

Avoiding the Trap:

- Buy Within Your Means: Choose a home that you can comfortably afford without straining your finances.

- Consider Renting: If the market conditions are unfavorable, renting might be a better financial decision.

- Invest Wisely: Diversify your investments rather than putting all your money into real estate.

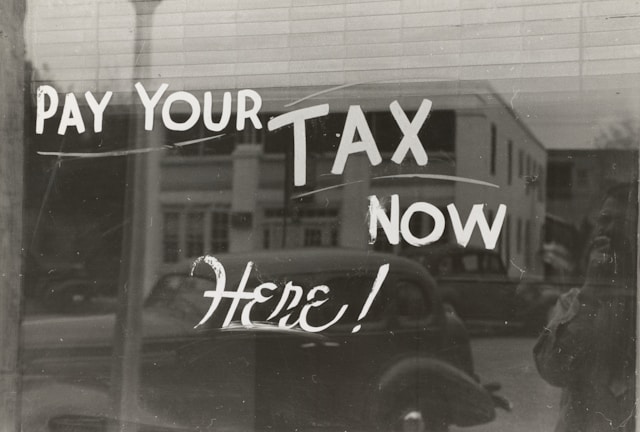

3. Taxation Troubles

Taxes can be one of the largest expenses over your lifetime, yet many overlook effective tax planning.

Why It’s a Trap:

- Lack of Planning: Not utilizing tax deductions and credits can result in paying more than necessary.

- Ignorance of Tax Benefits: Missing out on opportunities to reduce taxable income through investments and retirement accounts.

Avoiding the Trap:

- Hire a Professional: Consult with a tax advisor to optimize your tax strategy.

- Stay Informed: Keep up-to-date with tax laws and changes that could impact your finances.

- Utilize Deductions: Take full advantage of available tax deductions and credits.

4. Investment Myopia

Many believe that investing is the quickest way to wealth, but this isn’t always true.

Why It’s a Trap:

- Short-Term Focus: Focusing only on short-term gains can lead to risky investment choices.

- Overlooking Compounding: Long-term, consistent investment typically yields better results through the power of compounding.

- Lack of Diversification: Putting all your money into one type of investment increases risk.

Avoiding the Trap:

- Diversify: Spread your investments across various asset classes.

- Think Long-Term: Prioritize long-term growth over short-term gains.

- Educate Yourself: Continuously improve your knowledge about investment strategies.

5. Consumption Culture

The pressure to maintain a certain lifestyle can lead to financial strain.

Why It’s a Trap:

Why It’s a Trap:

- Keeping Up with the Joneses: Spending money to match peers’ lifestyles can lead to unnecessary debt.

- Luxury Purchases: Investing in depreciating assets like cars and designer goods instead of appreciating ones.

- Lack of Savings: Prioritizing current consumption over future financial security.

Avoiding the Trap:

- Mindful Spending: Focus on needs rather than wants.

- Value Experiences Over Things: Invest in experiences that bring joy rather than material goods.

- Save and Invest: Allocate a portion of your income towards savings and investments.

Conclusion

Breaking free from the middle-class traps requires conscious effort and strategic planning. By understanding the financial pitfalls that commonly ensnare many, you can take proactive steps to avoid them and work towards achieving true financial independence. Remember, financial success isn’t just about earning more; it’s about making smarter decisions with what you have.

Ready to take control of your financial future? Share your thoughts in the comments below, and don't forget to subscribe for more insights on achieving financial freedom.

FAQs

-

Why are credit cards considered a financial trap?

- Credit cards can lead to high-interest debt if not managed properly, creating a cycle of borrowing that is hard to break.

-

Is owning a home always a good investment?

- Not necessarily. Homeownership comes with many hidden costs and long-term financial commitments that might not always pay off as expected.

-

How can I reduce my tax burden?

- Consult with a tax advisor to make sure you are taking advantage of all available deductions, credits, and strategic planning opportunities.

-

What is the best investment strategy?

- A diversified, long-term investment strategy that leverages the power of compounding is typically the safest and most effective.

-

How can I avoid falling into the consumption trap?

- Focus on mindful spending, prioritize saving and investing, and avoid making purchases to keep up with others.

External Links: